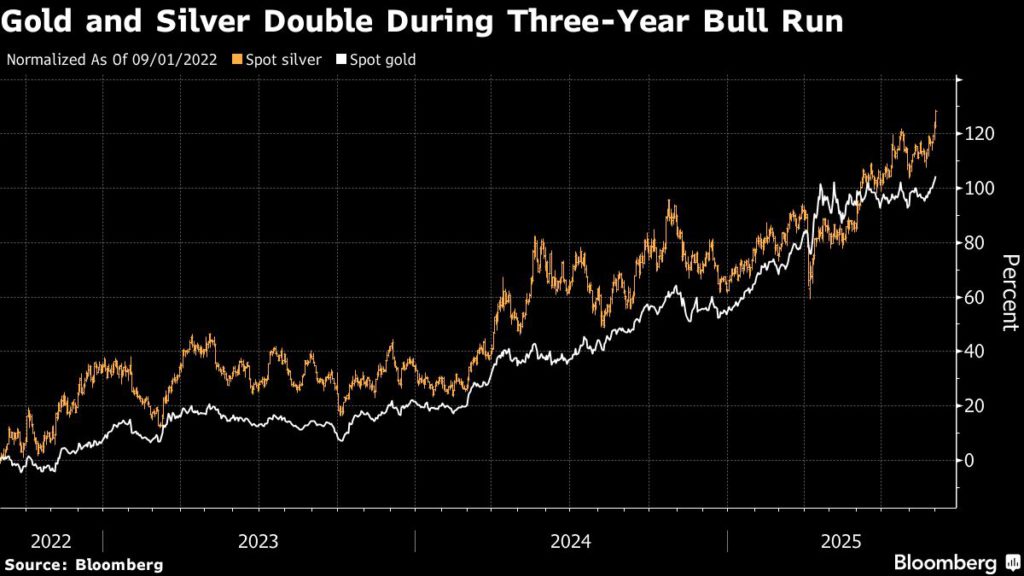

Spot silver surged above $40 an ounce for the first time since 2011 as mounting expectations for US Federal Reserve rate cuts gave fresh momentum to a multi-year bull run in precious metals.

Prices jumped 2.7% to $40.72/oz, the highest since September 2011 on Monday morning. Gold also advanced up as much as 1.2% to trade just below its April record above $3,500/oz.

“Gold, and especially silver, extended Friday’s strong gains, supported by sticky US inflation, weakening consumer sentiment, (expected) rate cuts … and concerns over Fed independence,” said Ole Hansen, head of commodity strategy at Saxo Bank.

“Key resistance levels around $3,450 for gold and $40 for silver were breached, triggering momentum buying,” added Charu Chanana, strategist at Saxo Capital Markets.

Tim Waterer, chief market analyst at KCM Trade, said, “Silver is making a move higher in response to expectations of lower rates, while a tight supply market is helping to maintain an upward bias.”

Policy expectations firmed after San Francisco Fed President Mary Daly reiterated support for a rate cut in a social-media post last week, citing labor market risks.

“The market is watching for Friday’s US job market report, anticipating that this would allow the Fed to resume rate cuts from September onwards (given) this supports investment demand,” said UBS analyst Giovanni Staunovo.

A Reuters poll shows August non-farm payrolls are expected to rise by 78,000 jobs, compared with 73,000 in July.

Federal Reserve concerns

Precious metals also drew support from rising haven demand after US President Donald Trump’s repeated criticism of Fed policymakers fueled concerns over the central bank’s independence.

Trump’s move to fire Fed Governor Lisa Cook a week ago concluded without a judge’s decision on Friday, and a ruling on whether she can continue her duties is not expected before at least Tuesday. Markets view the outcome as having potentially major implications for global risk sentiment and confidence in US institutions.

Separately, a federal appeals court ruled that the president’s global tariffs were illegally imposed under an emergency law, upholding a May ruling by the Court of International Trade. The judges allowed the levies to remain in place while the case proceeds, suggesting any injunction could be narrowed.

Banks see more upside

“Fed rate cuts, a weakening USD, rising ETF inflows and better Indian imports should all be supportive for gold and silver,” Morgan Stanley analysts Amy Gower and Martijn Rats wrote in an emailed note to Bloomberg.

“We see around 10% further upside for gold, while silver is trading almost at our forecast, with potential to overshoot.”

(With files from Reuters and Bloomberg)

source: mining.com